News and Insights

New laws on using phones whilst driving

Insights for BusinessFrom March 25 2022, drivers will be deemed to be breaking the law if they use a mobile phone for "any use" whilst driving. Our team discuss how to check your motor fleet's awareness of safe driving and in particular, their knowledge of the new rules.

When did you last risk assess and train your drivers?

Insights for BusinessAs businesses continue to navigate the post-pandemic world, the use of motor vehicles is steadily increasing. To assist with Driver Training, we are pleased to announce the launch of our new Driver Assessment System, part of our RMworks proposition, which is designed to assist organisations to assess their drivers' skills and shape training requirements.

Insurance coverage consideration for a SPAC and De-Spac

Insights for BusinessSPAC / DE-SPACS are used as vehicles for a company to raise capital and require specialist insurance coverage to protect the management team and assets.

Is it time to reassess the value of your luxury watch?

Insights for BusinessWhether it’s for personal use, a gift for a loved one or a purchase primarily for investment purposes, these brands have historically increased in their value every year - making it even more important that your insurance cover reflects the value of these possessions accurately throughout the year.

Mitigating the risks of latent defects

Insights for BusinessHow can contractors benefit from a Latent Defects Insurance solution? With contractor insolvencies continuing in 2022, our expert team discuss why all firms should have Latent Defect insurance.

Timber in Construction – Risk v Reward

Insights for BusinessHow does the insurance industry view timber construction projects? Our expert team discuss the benefits of using timber and how underwriters view these projects.

Irish Government react to challenges in Professional Indemnity (PI) Insurance market

Insights for ProfessionalsIn a press release dated 9th February 2022, the Minister for Public Expenditure and Reform, Michael McGrath TD, announced details of revised procurement and PI insurance guidelines for public works projects...

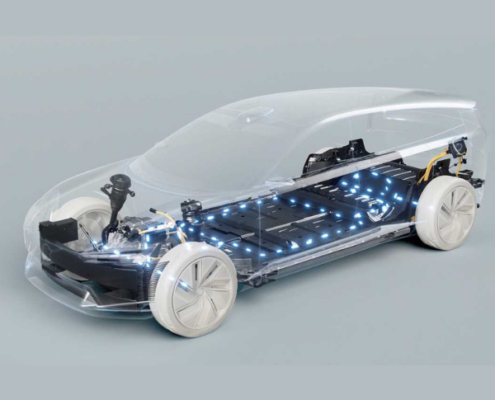

Managing your risk through the Electric Vehicle Revolution

Insights for BusinessHow can your business manage risk through the Electric Vehicle Revolution? We ask businesses and the insurance market for their perspective.

Accidents, Repair Costs and Total Losses of an Electric Vehicle – The Insurer Position

Insights for BusinessWhat is the current position of insurers when dealing with accidents, total losses or other key claims considerations involving Electric Vehicles you own, now or in the future?

The costs, challenges and benefits of operating an electric vehicle fleet

Insights for BusinessTom Goodman, Senior Ops Manager, Ground Control, gives Griffiths & Armour the inside track on their journey to transition to Electric Vehicles which began in 2014.

Electric Vehicles – The New Norm, With New Risks

Insights for BusinessFind out our Top 10 risk management considerations to take if you manage an EV fleet or are considering purchasing EV vehicles in the future.

Sustainability in Construction – buzz word or the future for the industry?

Insights for BusinessWhat is sustainable construction? Construction Brokers, Gina Charles and Emma Snelson discuss how to make construction projects more sustainable and how insurers view sustainability.

The Construction Industry – reflecting on 2021 and what to expect in 2022

Insights for Business, VideoConstruction Insurance Brokers, Emma Snelson and Gina Charles reflect on challenges faced by the construction industry in 2021 and predictions for 2022.

G&A celebrate with Merchant Taylors’ School on historic 400+1 anniversary

Insights for BusinessGriffiths & Armour would like to congratulate all staff, students (past and present) and parents at Merchant Taylors’ School in Crosby, on reaching the incredible milestone of 400+1 years at a recent celebratory dinner held at Liverpool FC’s Anfield Stadium.

Cyber Insurance in 2022 – Do you meet insurers’ new requirements?

Insights for BusinessAs a result of a significant increase in claims and heavy losses incurred by the insurers caused by ransomware attacks on their customers in 2021, insurers have significantly raised the bar on the security standards required by businesses to purchase cyber insurance, leaving little time for organisations to catch up.