In previous communications, we have reported on conditions prevailing within the PI Insurance market and the challenges for construction consultants. A feature of the market in Ireland and internationally is greater risk selection by insurers and an increased focus on specific areas of activity, with fire safety being a prime example.

As previously reported, the tragic fire at Grenfell Tower in London has raised the profile of fire safety and resulted in more detailed underwriting assessments. The combustibility of cladding is possibly less of a concern in Ireland, but fire safety is a recurring theme and particularly so when it comes to legacy risk and ‘Celtic Tiger’ era developments. What these developments, and indeed Grenfell, have brought home to insurers, is the catastrophic nature of the risk, the unknown perils that can exist and the need to manage their potential exposure. That exposure can attach in a number of ways and quite often consultancy firms will find themselves drawn into claims on matters that were not necessarily within their original scope of services.

The response from insurers has not been uniform in relation to the cover for ‘Fire Safety Notifications’ (FSNs). Some simply avoid firms that have exposure on certain types of developments, and others look to restrict cover to aggregate. Some will apply inner limits and an increasing number will not underwrite ‘fire safety’ cover at any price. It is also important to understand that this is a changing situation and whatever cover a firm holds today, they need to be prepared for the possibility of future restrictions down the line.

Our Scheme Facilities

The cover that is currently generally available under our Irish Scheme facilities is as follows:

-

- Most clients’ covers will be restricted to provide a single aggregate, costs inclusive limit of indemnity in respect of FSNs. This is a defined policy term and means that any losses or costs directly or indirectly relating to:

- the combustibility or fire performance of cladding or roofing systems;

- any internal fire protection systems; and

- any aspect of the fire safety or fire performance of a building or structure

will benefit from a single aggregate limit of indemnity only, with the uninsured excess applying to defence costs.

- For clients that already have inner limits of indemnity, special excess provisions or outright exclusions, these will likely remain unchanged, and any ‘bespoke’ wording will generally be no wider than that outlined above.

- Most clients’ covers will be restricted to provide a single aggregate, costs inclusive limit of indemnity in respect of FSNs. This is a defined policy term and means that any losses or costs directly or indirectly relating to:

Obviously, this has implications for both past and future contractual obligations and over the past year, we have been working with clients to determine whether and how these changes should be communicated to employers and other parties.

Of course, there is no ‘generic’ advice that anyone can provide here that will represent the best course of action in all circumstances.

Whether you want to communicate the basis of cover to your clients and, if so, the extent to which you would want to, will turn upon a number of factors. Each client and each project that you undertake for them might give rise to a separate range of issues that mean that a course of action which is ‘right’ for one project, might not be right for the next.

This FAQ document, which is no substitute for specific advice, explores some of the most pertinent and frequent scenarios. Whilst we acknowledge the support and guidance of Beale & Co Solicitors in putting this note together, it is important to state that this is not legal advice. After considering your position, should you feel that legal advice is required, we provide the details of our legal helpline below.

At the outset, it is particularly important to note that these issues are industry wide. Many professional firms are struggling to maintain the specification of cover that has applied under their PI policy and are seeing the introduction of restrictions or exclusions in certain areas of activity. On that basis, you will neither be the first (nor the last) to raise these issues with clients.

It’s a complex and changing landscape, but based on the discussions we have been involved in to date we have tried to consider the key questions that have arisen:

FAQ 1 - I have aggregate cover for fire safety claims. What steps can I take to protect my position in new contracts?

There are essentially three levers that can be pulled in this regard:

First, we strongly recommend that all contracts contain drafting to state that you are only required to maintain the PI insurance cover insofar as it is available at commercially reasonable rates and terms. This is a crucial protection to secure against future changes to your PI cover and should be seen as the ‘minimum’ specification for addressing this issue and is an entirely equitable position. Any individual professional does not control the basis of cover that the market is prepared to provide. It should set no significant ‘hares running’. It has been a standard recommendation made by us on behalf of our clients for over 15 years. Example drafting is as follows:

‘’The Consultant shall maintain professional indemnity insurance with a limit of indemnity of €[X], for a period of [X] years from the completion of the Services, completion of the Project or termination of this contract, whichever is the earlier, provided such insurance continues to be offered at commercially reasonable rates and terms to the Consultant at the time when the insurance is taken out or renewed’’.

This should provide a sound legal basis for justifying any future deviations from the required insurance specification under the contract, both as regards fire safety matters and any other issues.

Second, our advice is that the aggregate nature of cover for fire safety is clarified in any PI clause in your contracts, in the same way that the standard aggregate limits for pollution / contamination and asbestos are disclosed.

You will not be alone in calling for these changes. Others within your peer group will have been requesting such changes already and we have seen a huge increase in bespoke ‘confirmations of cover’ requests to secure more information on fire safety matters.

Third, we would also suggest that further measures should be considered in order to limit your liability in relation to FSNs. In particular, we would recommend the following clauses for inclusion in relevant contracts:

- an evaporation provision which should be included in addition to the ‘normal’ financial cap on liability:

.“Without prejudice to any provision in [this Agreement] whereby liability is excluded or limited to a lesser amount, the liability of [the Consultant] in respect of any one claim arising from one source or originating cause and in total for all claims arising under or in connection with [the Agreement] whether in contract, tort (including negligence), for breach of statutory duty or otherwise in respect of:- the combustibility, fire protection performance, fire resistance and/or fire retardant characteristic of any external cladding or roofing systems;

- any internal fire protection systems; and/or

- any aspect of the fire safety or fire performance of a building or structure

shall be limited to the greater of (a) €[X,XXX consider negotiating a value equivalent to your policy excess. This will be an uninsured loss.] or (b) the amount, if any, recoverable by the Consultant by way of indemnity against the claim or claims in question under any professional indemnity insurance taken out by the Consultant and in force at the time that the circumstance that might give rise to the claim or claims or if later the claim or claims is or are reported to the insurer in question.”

This would be particularly prudent for those consultants that have significant exposures in this area.

Care will need to be taken when using this clause and we must stress that should a different claim absorb the limit of indemnity you have for FSNs, your liability will be limited to the amount included at (a) above. It is important to note that this will be an uninsured loss, and so careful thought should be given to the amount inserted.

That said, we do know some clients are content to rely on the ‘standard’ evaporation wording for other matters (such as terrorism and asbestos) and you may elect to take that approach here too as this might mitigate the risk of an uninsured liability arising, were the courts to find it enforceable.

- where it is prudent to do so and where there are no identifiable ‘fire safety’ exposures, consideration could be given to a total exclusion of liability for fire safety claims, as per the following drafting:

.“Without prejudice to any other provision of [this Agreement], [the Consultant] shall have no liability whatsoever or however so arising in respect of any claim, losses, liability, cost, expenses or other costs directly or indirectly arising out of or in connection with:- the combustibility, fire protection performance, fire resistance and/or fire retardant characteristic of any external cladding or roofing systems;

- any internal fire protection systems; and/or

- any aspect of the fire safety or fire performance of a building or structure.”

Given the breadth of the policy exclusion and the anticipated client reaction, this is a lever that needs careful consideration and is perhaps most likely to form part of an overall negotiation strategy (as opposed to the ultimate position accepted).

FAQ 2- In what circumstances should I be implementing some or all of these recommendations?

Having considered what steps can be undertaken, it’s important to consider the likely scenarios in which those steps might need to be implemented. Some will appear clear cut, whilst for other scenarios there might be a much more nuanced picture with no obvious ‘right’ answer:

- New clients

All other things being equal, we suggest that you address the changed nature of cover when negotiating a new contract with a new client with whom you have no previous dealings. Issues around historical and current work undertaken and the contracts already in place are not relevant here. There is something akin to a blank canvas which allows you maximum freedom to pursue all the protections recommended. Inevitably, there are commercial aspects to this negotiation around offering what your client may perceive as the ‘widest’ possible cover. That said, virtually all insurers are now either offering aggregated cover in this area or excluding cover in its entirety, so it is well on the way to being a new industry norm. Our team at Griffiths & Armour are happy to support our clients in their negotiations.

.

It is important that the basis of your cover is reflected in your appointments and you should consider:- Liability – we recommend that the appropriate limits of liability are inserted, to reflect the wording of your policy (see above example clauses). Arguing for the limitation clauses is perhaps more commercially sensitive for these types of discussion, but ultimately the client needs to recognise your value to the project is much more than the specific insurance cover you can offer in this area.

- Insurance – your insurance obligations under the contract should mirror the insurance cover that you have (or be less than them). It will also be very important that contracts make clear that you are only required to maintain professional indemnity insurance insofar as it is available at commercially reasonable rates (see FAQ 1).

- Services – where possible, minimise your responsibility for fire safety or performance (and expressly exclude these services from your scope if they are not relevant). If you are not able to do so, you should consider the insurance cover you have and whether it would be appropriate to appoint another consultant (who may have appropriate insurance) to carry out those services.

- Existing clients

For discussions on new contracts with existing clients, you will need to take a view as to how addressing these issues in the new contract may impact existing contracts which you are already delivering and the relationships that go with them (see above). This is not to say that we recommend ‘staying quiet’ here, but clearly raising this issue will impact other contracts and you need to be mindful of that. It must still be right to push for all the applicable protections suggested above. It is just that the context of the how the request for those protections may be received will be complicated by the existing relationship..

Each contract and project will need to be considered on a case-by-case basis. The changing PI insurance market, and generally the hardening contractual market, will likely present you with grounds to justify a request to your client to include the protections and provisions referred to. Your client is likely to be ‘alive’ to these issues, and such requests should not come as a surprise.

.

This aspect is closely linked to the question below, “What about contracts that I’ve already signed?”, but just focusing on the approach to the aspects associated with ‘new contracts’ for ‘existing clients’, several areas seem to us to be important:- As ever, the most important asset is your relationship with your client. So, it is always worth asking yourself:

- Is the current negotiation with a trusted client, who understands your business, the environment in which consultants operate, and the market more generally?

- Is the discussion going to be non-adversarial and solution driven, or an exercise in apportioning blame?

We can’t provide advice here, but the ‘soft’ skills of understanding your client’s reaction and therefore how to proceed is clearly invaluable.

- What proportion of your contracts with that client contain the ‘commercially reasonable rates and terms’ clause?

If that proportion is high, you will have good leverage on your portfolio of work to call for changes not just on the new contract, but also on the historical activity. This needs a careful, moderate approach, but it may at least allow you to maximise your protection in this area. Even if the proportion is not high, you should approach your client on the basis that the market is changing and to request that this drafting is included in contracts moving forward. - To what extent does raising this as an issue potentially impact other contracts with this client, particularly those that aren’t going so well, or on which claims matters have arisen?

- As ever, the most important asset is your relationship with your client. So, it is always worth asking yourself:

FAQ 3 - What about contracts that I’ve already signed?

Unlike ‘new’ contracts with ‘new’ clients, tackling the question of how to approach those contracts which have already been signed is an area where there is considerable nuance and no ‘standard’ approach which suits all situations.

Each case will turn on its particular facts, including;

- Does the project bring with it significant fire safety exposures?

Some projects and some clients will obviously undertake work for which the chances of a FSN arising are minimal: geotechnical engineering, for example. Others will be undertaking work for which a FSN is perhaps likely: fire consultants, for example. In between is everything else.Deciding how much of your current contracts you want to revisit is a question only you can answer. We recommend that an audit of the relevant existing contracts is carried out to ascertain any risks arising under the contracts. How much time and resource you want to target at this aspect is very much a question for each insured to consider.

- What stage of delivery are you in respect of your services, and to what potential liabilities are you exposed?

It is hard not to arrive at the conclusion that for completed projects with minimal fire safety exposure, the best advice might be to say and do nothing, unless you are specifically asked, or issues arise. Conversely, those embarking on a project with some fire risk might want to improve the quality control environment around that work at least, or perhaps take things further by bringing some of these issues to the attention of your client. Where you are up to with the project is a factor to consider..

As a result of the reduction in cover, you should be considering approaches other than insurance to managing your risk under each appointment. If you are still providing services under the contract, you could look to enhance the supervision of those involved. You could consider whether further management techniques, such as a peer review of the services being carried out, is warranted. If services have been completed, you should still seek to monitor any developments in relation to the project and consider any communications from your client in order to mitigate any liability (potentially now subject to restricted insurance cover) that may arise. - What contractual protections you already enjoy and what are the insurance provisions?

The extent to which you have provisions in your contract that will help you deal with this issue is a key factor. See below for what those provisions are. - Your relationship with your client and any particular existing known problems and/or claims issues.

Relationships are vital, but don’t forget that contractual agreements trump even a strong relationship and when claims arise even close personal friendships can be tested to breaking point. If there are any claims issues on a project, particularly those with a fire safety element, then an abundance of caution about the approach to take is the best advice. Reaching the wrong decision could mean a loss of earnings, attempts by the client to terminate the contract or even encourage the client to bring claims. As ever, we would hope that clients in this situation would approach us for specific advice from ourselves and subsequently our legal panel.

We offer some further guiding principles to assist your efforts to tease out some of the issues in answering what seem to us to be the critical questions as regards existing contracts:

- Am I obliged to tell my client that my insurance has changed? (we tackle this in a separate FAQ below)

The first thing to consider when thinking about notifying clients of a change in your insurances is to consider the existing contractual requirements you have signed up to. Do they require you to notify the client of any changes? If the contract specially requires you to notify of any changes, see the ‘frequently asked question’ below. - Should I tell my client that my insurance has changed? Consider the nature of the insurance requirements to which you have signed up.

Is the PI requirement specifically set out and does it require ‘each claim’ cover, save for specifically noted exceptions to this principle? If the contract requires aggregate cover only, then the need to notify is greatly reduced. More usually, however, ‘each claim’ cover is required with specific exceptions. - Do you have a ‘get out of jail’ card?

.

The next step to consider is whether the obligation is caveated that the cover will be “maintained at the agreed level and on the agreed terms, providing it remains available in the market at commercially reasonable rates and terms”.

.

‘Yes’

.

If your contract contains this proviso then this provides a sound legal basis on which to have a discussion with your client and secure at least a recognition that the revised cover you can provide is satisfactory.Additionally, the inclusion of this wording means that you are unlikely to be in breach of the insurance obligations in those appointments as a result of a change in your PI insurance cover. It is clear that unrestricted cover for FSNs is not generally available in the market at commercially reasonable rates and terms. We are therefore happy to provide a letter to this end for you to share with your client to assist with securing a recognition that cover has changed.

‘No’

If your contract does not contain the proviso, then the situation is more delicately balanced. Failure to maintain the insurance as set out in the contract means that you will be in breach of contract. However, given that the client is unlikely to have suffered a loss solely as a result of your failure to maintain the insurance required, you should seek to avoid notifying clients unless you cannot avoid doing so.

- To what extent could my services attract a FSN?

This question is key because, as you’ll have read above, the extent to which your services could attract a FSN is broad, depending on how broadly your ‘Scope of Services’ is drafted.Because of the wide-ranging definition of this insurance provision, and its newness to us all, a prudent approach is probably to be quite expansionist as to how likely this might be.

Architects and specialists in fire safety will likely have already been through several renewals where these questions have arisen, though now those who may never have even considered this an issue will need to undertake an assessment of their work to see if they are impacted.

Building services engineers are one such profession and are a group who ought to take particular care given not only the potential for the scope of their work to be caught up here, but also because they are the new focus of some of the insurance markets’ latest concerns.

If as a result of your assessment, you determine that your services on the particular project are unlikely to generate any FSNs, then you may elect to simply stay silent on the issue and take no further action. Of course, this position may be altered by specific client requests for further information on your policy position and that is something that you will need to discuss with your usual G&A contact.

On the other hand, should you determine that you do have exposures to FSNs, then you need to first decide if that is something you should notify your client about. As mentioned above, the client is unlikely to have suffered a loss as a result of your breach of the contract (in failing to maintain the insurances required), and therefore, a claim for breach of contract is, in the view of some legal commentators, likely to be low risk (but a risk nonetheless).

It may be better to give consideration to strengthening your risk management environment on those affected contracts to mitigate the chances of a claim arising in the first place. This could be through:

- Determining which contracts are most likely to give rise to issues and ensuring the team(s) involved are aware of the issues.

- Adding in a requirement (where it doesn’t already exist) for internal or external peer review of the work to further limit the chances of errors arising and mitigating against future claims.

- Ensuring that you are entitled to rely on third party documents or information provided to you under the contract. If this is not possible, any reliance on third party information should be supported by a robust checking regime to avoid being drawn into claims as a result of the errors of others which may bring significant exposures as a result of ‘joint and several’ liability.

- Can I do anything further to protect my position?

Some firms may want to go further and vary the existing contract terms to make reference to the restricted cover in the PI clause, and/or incorporate any additional limitations or exclusions of liability (see FAQ 1). This may not be a viable option in most circumstances. Nevertheless, depending on your relationship with the client, this option should be considered at the very least. As mentioned above, where you are required to carry out fire related services, you should consider whether it would be appropriate to appoint another consultant (who may have appropriate insurance) to carry out those services. Consideration could also be given as to whether the client should be appointing these specialists directly.

FAQ 4 - Do I need to notify all of my previous clients of the change to my cover?

Some contracts will contain an obligation to notify the client if cover is no longer available on the agreed terms, so that the parties can discuss the best way of protecting their respective positions.

If this wording is included in your contract, then you have a clear contractual duty to make that client aware of the change in your cover. You could also offer to undertake some of the ‘risk mitigation steps’ noted in FAQ3 in order to reduce both your and your clients’ exposures for contracts which are still ‘live’.

Without this wording, there is generally no obligation to notify of any changes, though you are likely to be asked for updated confirmations of cover at renewal. As we stated at the outset, often these come with requirements to go into some detail on your fire safety position, so it is worth thinking about the various issues explored in this FAQ document. If you need a letter to support your discussions with clients, we would be happy to assist.

FAQ 5 - What are the potential sanctions?

Consideration will need to be given to the potential sanctions that may apply for failure to notify a change in cover and/or maintain the level of insurance agreed to under the contract.

We set out below some example clauses that may help you consider the range of potential effects:

- A right for the client to withhold payment in the event that the insurance is not maintained:

No further amounts shall be due to the Consultant under the Contract until the Consultant provides evidence that the insurance required by this clause is being maintained.

. - A right for the client to terminate the contract for failure to maintain the insurance required:

Without prejudice to any rights and remedies available to the Client, the Client may terminate this Contract with immediate effect by giving notice to the Consultant, if the Consultant fails to take out and maintain the insurance required by clause [X].

. - A right for the client to maintain the insurance on your behalf and recover the cost of doing so:

If the Consultant fails to take out or maintain the insurance required under clause [X], the Client may itself insure against any risk in respect of which the failure shall have occurred and a sum or sums equivalent to the amount paid or payable by the Client in respect of premiums therefore will be deducted by the Client from any monies due or to become due to the Consultant under this Contract or, if the Contract Price has been paid by the Client in full, such amount will be recoverable by the Client from the Consultant as a debt.

FAQ 6 - What about my supply chain exposures?

Having considered your own insurance and liability position, it’s important to reflect on the fact that your own sub-consultants are very likely to be wrestling with the same problems.

This means that your ability to ‘flow down’ FSN claims to any culpable sub-consultants may be reduced. This could mean that you are faced with a greater share of any claim than would otherwise be the case.

As mentioned earlier, there is still likely to be a spectrum of cover available in the market for the medium term and you might want to give thought to understanding in some detail the nature of the PI cover your supply chain are offering.

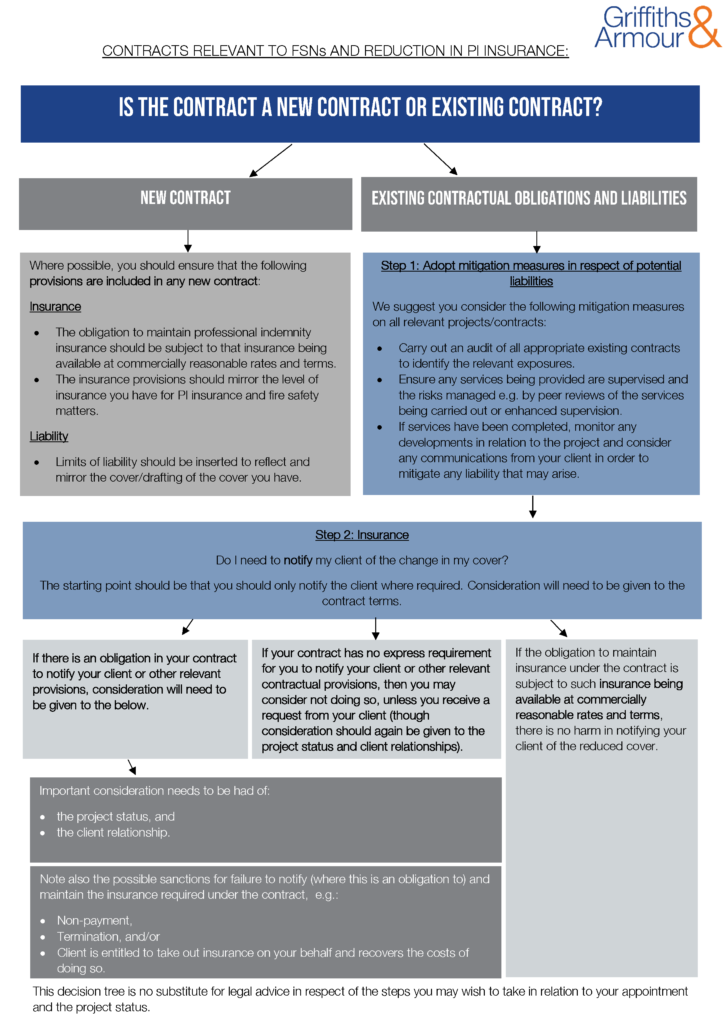

We appreciate there is an awful lot to take in here, and have set out some possible options and considerations in the decision tree below to allow you to find your own ‘way through the woods’ on these highly complex issues:

Your regular Griffiths & Armour contact will of course also be happy to assist wherever possible in managing queries raised by your clients on this matter. Should you wish to discuss any legal questions arising from the issues raised, we would encourage you to seek assistance from one of our panel member firms, details of whom are included here.

We would also like to acknowledge our thanks to Will Buckby and Killian Dorney, of Beale & Company Solicitors, for their invaluable insight and guidance into the legal aspects of the issues raised.