On 31 May 2021 the Ministry of Justice (MoJ) Whiplash Reform Programme will be implemented. The new programme, which has been eagerly awaited by the insurance industry since the Civil Liability Act was passed by Parliament in 2018, applies to claims resultant from road traffic accidents (RTAs) which occur after the start date of 31 May 2021.

What are the ‘Whiplash Reforms’?

A package of measures introduced by the Government to reform the way low-value personal injury claims arising from RTAs are managed. Taken together, the reforms will:

“reduce insurance costs for ordinary motorists by tackling the continuing high number and cost of whiplash claims”

Source: Ministry of Justice

- The Measures:

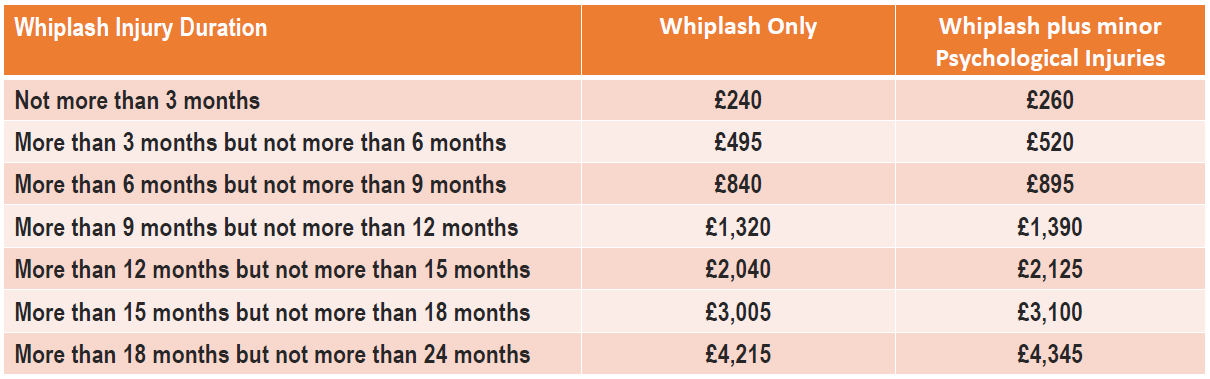

Introduce a new fixed tariff of damages for pain, suffering and loss of amenity (at the lower end are significantly lower than previously set by the Judicial College Guidelines (JCG)) – see table below - Ban claims being settled without a medical assessment

- Raise the Small Claims Track (SCT) limit to £5,000

- Introduce of a new pre-action protocol and portal process encouraging individuals where possible to make claim in person without the need to instruct legal representation by access to the new Official Injury Claim (OIC) Portal

Also, whiplash claims below the new SCT limit are no longer cost bearing (only issue fee, some disbursements and hearing fees are recoverable)

New fixed tariff for whiplash (general damages)

* The figures outlined in the table above may be uplifted by 20% in exceptional circumstances

** Minors + vulnerable road users are excluded from the OIC Portal process and will follow the fast track process irrespective of value.

A new Official Injury Claim service

MoJ has instructed the Motor Insurance Bureau to manage delivery of a new service to support RTA personal injury claims that fall within the new SCT limit. The Official Injury Claim (OIC) service, will be accessible for any individual looking to make a low-value personal injury claim valued up to £5,000 (to a maximum total of £10,000 for all losses) without needing any legal support. The aim is to simplify the personal injury claim process making it quick, unbiased and secure for everyone.

It will be run separately from the existing RTA Claims Portal used for higher-value (fast track) claims and will be available both to individuals who bring their own RTA personal injury claim, and to organisations who bring a claim on an individual’s behalf.

It is a multi-channel service, providing the option of filing a claim online, through a telephone customer contact centre or, if necessary, through a paper-based process. It will direct a claimant to the appropriate track channel if their claim breaches the value threshold of the SCT process.

The service is designed to integrate with other key insurance industry systems such as the Motor Insurance Database, which will send automatic notification to the Motor Insurance Database matching insurer inviting them to be compensator of the claim.

A claimant can include associated vehicle costs on the OIC Portal which are known as ‘Protocol Vehicle Costs’.

Key points:

- The insurer now has 30 working days to make a liability decision.

- If liability is denied in full or part, the responder can upload evidence to support their case.

- If no liability response is made within the 30-day timescale then there is a deemed presumption that the insurer has admitted liability.

- Liability admissions are binding on the insurer for a claimant’s personal injury claim but importantly not in relation to Non-Protocol Vehicle Costs e.g. insurer repairs or credit hire claims. These can still be disputed outside of the OIC Portal.

- Where liability is denied then the claim will drop out of the OIC Portal process and claimants must then issue proceedings without a medical report in order to pursue their case on liability to a SCT Hearing in the County Court before a District Judge. Salford County Court/County Money Claims Centre will be the Court processing small claims arising from the Portal.

- If the claimant is unsuccessful then that is the end of the case. However, if the claimant succeeds in full or partially (i.e. a degree of contributory negligence) then the case will be transferred back into the Portal for a medical report to be obtained and thus a quantum valuation.

- The new OIC Portal will allow claimants to access and arrange their own medical assessment directly (via Medco) and request access to rehabilitation services offered by the compensator, if considered necessary.

- The claimant can include any own ‘Protocol Vehicle Costs’ on the OIC Portal. These are costs they have directly paid for or incurred themselves. i.e. policy excess or self-funded repair costs.

- Non-Protocol Vehicle Costs are those incurred by the claimant’s insurer or accessed via credit hire/repair companies etc and are excluded in the OIC process. It’s expected they will be dealt with under existing industry agreements between relevant organisations and insurers.

- Subject to liability agreement (in full or part), there can be three offers and counter-offers made. If all offers are rejected the claimant will be prompted via the Portal to commence Court Proceedings by requesting a Quantum Judgement or an Oral Hearing. The relevant court pack will be prepared and pre-populated, pulling information uploaded from the Portal.

What do these changes mean for you?

- Motor Insurance Database (MID) compliance: Ensure the MID is accurate. Make the necessary amendments immediately when vehicles are added or removed from your fleet. Failure to do so could result in you or your insurer becoming embroiled in claims in which you have no involvement.

- Have a clear policy in place for drivers to report all RTA incidents: It is very important that at the scene of the accident the driver obtains as much detail as possible particularly in relation the third party, third party vehicles and any passengers. Such information is vital to assist with any investigations so insurers can establish liability and maintain evidence that may be required at a future point.

- Day One Reporting: Ensure within the above that drivers are encouraged to report claims to accident managers/insurers as soon as it safe to do so.

- Immediately investigate and confirm/deny involvement in any alleged RTA: Under the new OIC process, insurers have only 30 days to make a liability decision, failure to do so will result in a binding assumed admission of liability.

In summary, the overall reforms are welcomed by the insurance industry although there is an expectation that there may be some initial practical challenges ahead for insurers in having to deal with a wholly new method and process of claims handling to manage in tandem with all existing processes.

The insurance industry and Motor Insurance Bureau must also monitor behaviours of claimant law firms, who may be incentivised to inflate or exaggerate claimant losses to push it into the fast track process whereby they have an entitlement to costs.

The Motor Insurance Bureau are to launch a social media and publicity campaign in May 2021 promoting the use of the OIC process.

As always, we are here to provide you with any support you need or to clarify any points raised in this update. Please do not hesitate to get in touch using the form below this article or via your usual point of contact at Griffiths & Armour who will be happy to help.