Written by: Griffiths & Armour on: 15 Feb 2022

Accidents, Repair Costs and Total Losses of an Electric Vehicle – The Insurer Position

On 18 November 2020 the UK Government announced an historic step towards net-zero, by declaring the end of sales of new petrol and diesel cars by 2030, with all new cars and vans, including Hybrid vehicles to be completely emission free from 2035. This is a huge step towards ending vehicle emissions from internal combustion engines (ICE) as a contributor to climate change and will put the UK on course to be the fastest G7 country to decarbonise cars and vans.

As part of its strategy, the UK government has also committed to significant investment to support greater uptake of zero emission vehicles for greener car journeys including developing the charging capabilities and infrastructure across the nation.

Motor insurers are already gearing themselves up for the seismic changes that are underway. It is in the insurance sector’s interest to be ready as these changes evolve so in the event your Electric Vehicle (EV) is involved in a claim, you can have confidence that your insurer of choice and their network of repairers have the capability to handle those repairs or, as is the case today with an ICE vehicle, to assess whether the vehicle is to be a total loss. The task is significant, and the insurance industry understands it has less than 10 years of rapid transition to navigate.

So, as a business owner with a fleet of vehicles that you may transition to EV or a private car owner considering purchase of an EV, what is the current position of insurers when it comes to dealing with accidents, total losses or other key claims considerations involving EVs you own, now or in the future?

To help answer this question, the team at Griffiths & Armour have consulted with several market leading insurers to check their position. The positive news is most insurers have made significant progress in relation to dealing with customer claims for EVs. By anticipating and preparing for the changes in consumer demand for emission free and hybrid vehicles, most insurers are now fully capable of handling the repairs of both EVs and Hybrids.

That said, there are still many challenges to overcome in this ever changing and evolving area of insurance.

From a claims perspective, the main challenges can broadly fit into two categories.

1. Repair Costs

The key considerations for insurers appear to be delays in obtaining parts and costs associated with those parts or repairs.

As EVs become more mainstream, market forces and the emergence of a larger network of repairers will undoubtedly drive costs down however, in the short to medium term, it is widely accepted the costs associated with repairing EVs and Hybrids appears to be higher than those for an ICE vehicle.

Average Costs for Repair

For example, one insurer advised that the average repair costs for an ICE vehicle is £1,574.00, however in the case of an EV, it rises on average to £2.4k. This can rise significantly again to an average £4.8k for some of the established high value EV models. The enhanced technology driver experience of an EV can also have an impact on repair costs. Windscreen replacements can go beyond simply replacing glass. An EV can involve much higher costs because some models have a windscreen that features display technology.

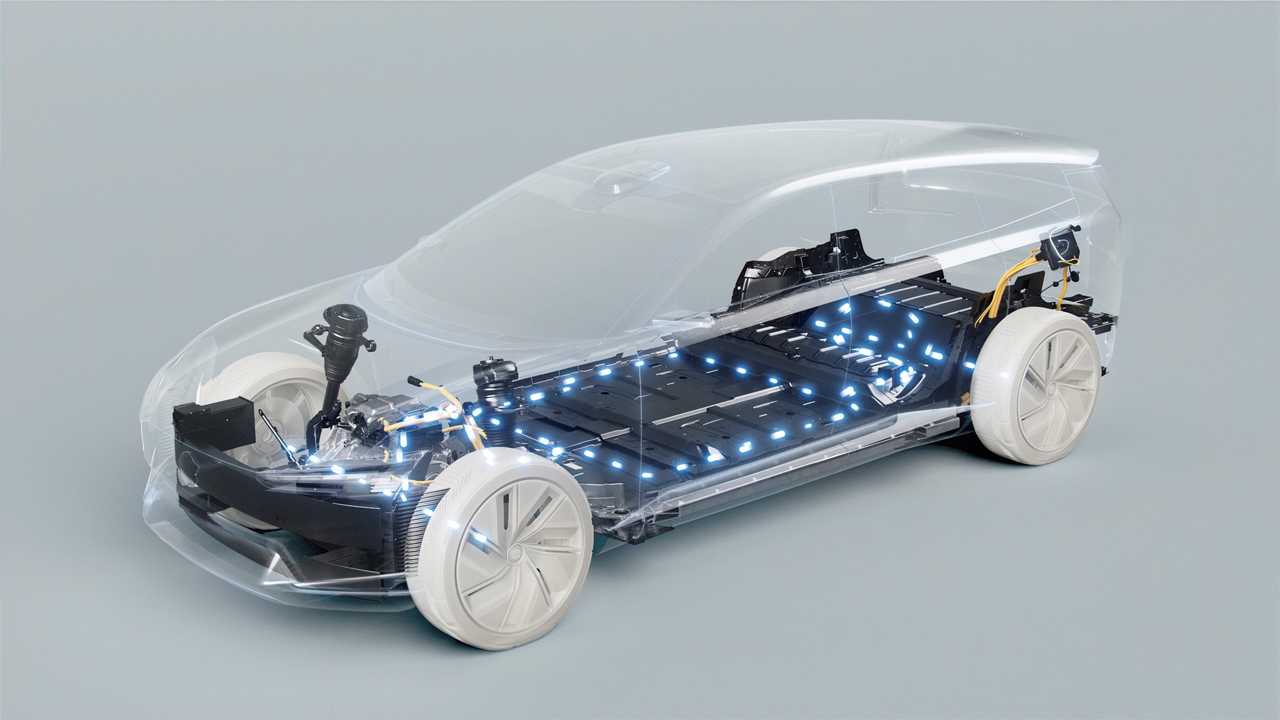

Decommissioning Batteries

As you would expect, there are differences in the repair methods of an EV vs an ICE vehicle and some of those differences can contribute to the increased cost of repairs for EVs. This includes it being necessary to decommission the battery to ensure that the vehicle is safe to work on and this can take up to an hour of an engineer’s time.

Validating Warranties

Checking and validating warranties has also been flagged as a challenge because some dealers safeguard the data in the vehicle, which can present difficulties when a network repairer is trying to carry out the repair.

Cost and Ownership of EV batteries

The battery is the most expensive part of the EV and in some instances can be 50% of the vehicle value. Ownership of the battery must also be checked when purchasing an EV, for example with one EV car manufacturer, their EV batteries are leased to the car owner. Another example which demonstrates the high cost of a battery replacement is that in one particular model of EV, the cost to purchase the car was circa £70k and the cost of installing a new battery in that same vehicle was circa £26k plus £1k labour.

Availability of Parts

As mentioned previously, as EVs become more mainstream and supply chains grow, access to parts will become more readily available however, in the immediate term, the experience of many insurers and EV owners is that availability of some parts is challenging. For example, one case involved a 7-month delay for parts on a Mercedes EV, so in these instances, some insurers may look to settle the claim on a Constructive Total Loss basis. This is because an accumulation of costs associated with delayed arrival of parts and any subsequent credit hire if a third party vehicle is involved in a road traffic accident may convince the insure to take a Total Loss approach to settling the claim. Despite this, it’s important to highlight that of the insurers we have spoken to, all confirmed that the vast majority of repairs can be done in a reasonable period to most EVs by their Approved Network of Repairers.

Gearing up the network of approved and qualified EV repairers has involved substantial change and training/recruitment for appropriately skilled mechanics and engineers.

In summary whilst insurers are capable of repairing EVs, getting the vehicle to the right place at the right time is essential to ensure the repair is carried out efficiently and effectively. As is the case with an ICE vehicle, we strongly recommend early reporting of a motor accident to your broker or insurer is essential to enable the insurers to manage the claim and control the repair on behalf of the client.

2. Total Losses

As mentioned in the previous section of this article, an unusually higher proportion of EVs (vs ICE vehicles) may, in the short to medium term, be deemed a total loss because the economics of repair outweigh the value of the vehicle.

One insurer we spoke to didn’t see the current ratio of repairs to total losses changing whilst EV market values remain high. As we see this market mature over the next few years, EV prices should fall, however a lot of their increased costs can be attributed to new technology and features becoming standard in EV vehicles e.g. advanced driver-assistance system (ADAS), which involves groups of electronic technologies such as sensors and cameras that assist drivers in driving and parking functions.

Other Considerations

It’s important to research EV manufacturers and historical performance or issues. For example, in some cases safety concerns have been raised by some consumers regarding the risk of potential battery fires, with Hyundai recently recalling 82 thousand vehicles as a result of this particular risk.

Other claims considerations include the safety aspects and legal liability concerns over the tripping risk from charging cable. It’s important to check the policy wordings of each insurer as they may differ however one insurer commented;

“whether this constitutes ’use of a vehicle’ under the Road Traffic Act will ultimately be for the courts to decide, however within the proposition changes we’ve made in our fleet insurance policy wordings, we will insure this risk as a motor risk irrespective”.

In Summary…

Having researched and discussed this with several insurers, Griffiths & Armour are confident that insurers are prepared for dealing with EV claims and repairs and are geared up for the changes to consumer demands switching to EVs in the years to come. There are clearly other influences outside of the insurance sector’s control such as a dependence on EV manufacturers and supply chains creating efficient networks that can cope with demand, including key factors such as parts being readily availability.

One insurer has even developed their owned network of bodyshops to handle EV repairs and they have also increased their network of preferred repairer to include Tesla approved repairers. Such is the importance and commitment in evolving with this emerging market, this insurer has also invested in a research and design facility in the UK.

One thing is certain, the Electric Vehicle revolution is well underway so as always, our team is on hand to answer any questions you have that relate to your insurance programme, including motor fleet insurances, claims or plans to convert to Electric Vehicles in the future. Please contact Julie Hunt (below) or your usual point of contact at Griffiths & Armour if you would like to have a discussion.

If you found this article interesting, you may wish to read the following related content;

Managing your risk through the Electric Vehicle Revolution

Electric Vehicles – The New Norm, With New Risks

The Costs, Challenges and Benefits of Operating an Electric Vehicle Fleet