Underinsurance has historically been one of the biggest problems faced by insured’s when trying to arrange settlement of a claim to replace property or interruption to their business.

The Chartered Institute of Loss Adjusters estimates underinsurance to be present in over 40% of claims, with the degree of insurance being in the region of 35% to 45%.

The ideal way to ensure adequacy of sums insured is via a professional valuation. QuestGates – Chartered Loss Adjusters, claims specialists and RICS members – manage a valuation facility for BIBA, and Griffiths & Armour has worked with them on a number of occasions. Business leaders must insure the correct value of their assets, and our service ensures that the application of average and hence reduced claims payments are avoided in the event of a loss. Below, we discuss different areas of your business that need an accurate valuation in place to protect you in the event of a claim.

What is under-insurance?

Under-insurance occurs when something is insured for less than its true replacement value, which results in inadequate insurance coverage. In the event that you are under-insured and you did need to make a claim, your insurer may ‘void’ the policy and refund all premiums paid. In some cases, an insurer may retract any money paid out for previous claims.

Alternatively, you may receive a reduced claims payment. Often policies include an ‘average clause’ which means that the insurer can reduce its liability for a claim by applying a proportionate settlement, or ‘apply average’. So, for example, if a building is under insured by 20% the claim will be reduced by this amount.

In order to offer some protection to our clients Griffiths & Armour have negotiated the removal of the ‘average clause’ from our bespoke Multi Trade Plus and Property Owners policy wordings providing the insured has an up to date valuation. As a guide, insurers will generally consider that a valuation exercise should be undertaken every 5 years to ensure that sums insured remain accurate.

5 reasons to get a valuation

- Recent renovation works have been undertaken to the premises including an extension which dramatically increases the floor area.

- A recent investment in additional machinery in order to increase productivity.

- Premises are a listed building which have not been valued for some time. Listed buildings are always likely to be more expensive to rebuild than their modern equivalent due to changing construction techniques.

- The business has performed extremely well over the last few years and revenue has increased significantly. A Business Interruption valuation will provide guidance on appropriate sums insured and indemnity periods.

- Peace of mind – construction costs can vary widely and if a valuation exercise has not been undertaken recently you have no way of knowing how accurate the sum insured is. The cost of a building valuation is relatively small compared to the potential consequences in the event of a claim.

If you’re unsure of the factors to take into account when you assess how much insurance and the valuation you need, we recommend that you get in touch with your usual Griffiths & Armour contact. Insufficient insurance cover will essentially mean any claim may not be fully covered.

Which areas of your business require a valuation?

Buildings Valuations

Throughout the valuation process, it is essential that your valuation is tailored to the requirements of your building and takes into account the specifics and extent of risks that may arise. Often, a building’s value of risk is incorrectly calculated by its market value, instead of the reinstatement cost, which can be influenced by many factors including local authority planning issues, legislation requirements and listed status of the building. If you under-insure the building, insurers could reduce your claim in proportion to the under-insurance.

Plant, Machinery and Contents

A full valuation will likely involve many days on-site to compose a detailed list of inventories as well as extensive research into the replacement costs.

Fine Arts and Antiques

Individual items of high-value, unusual pieces and collections all require an accurate valuation. Make sure to inform your insurance broker of all your valued possessions.

Business Interruption Surveys

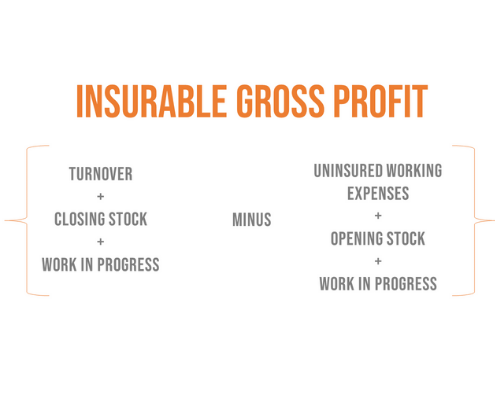

This cover will indemnify the insured against a decline in their financial earnings caused by insured physical damage. Not only does this cover the reinstatement period but the time for the business to recover fully to the position before the incident. It is integral that the valuation process includes a full financial review of the insured business. Additionally, it would be expected that you receive recommendations as to the type of cover needed, sums insured, indemnity period and policy extensions. It is important to note that the insurance definition of Gross Profit differs from the accountant definition. This mistake is often left unnoticed until a claim occurs which has catastrophic results for the policyholder. If you have underinsured, and the Gross Profit figure is vastly below the required level, then the policy will be unable to function as planned and the claim settlement will be less than is needed.

A common mistake made when calculating the gross profit figure is that the accounting definition is used rather than the insurance specific definition.

The importance of having an accurate valuation in place cannot be underestimated. Given the current insurance landscape, your valuation must be up to date and in place in case you have to claim in the future. Make sure to let your broker know about any changes to your business as it may impact the amount of insurance cover you need.

Businesses must be mindful of the potentially damaging impact that out of date valuations or undervalued assets can have when facing an insurance claim. It is essential to have a professional insurance valuation of your buildings and contents by a reputable firm of valuers regulated by the Royal Institution of Chartered Surveyors (RICS). Maintaining accurate valuations can prevent significant losses as claim pay-outs are vastly out of sync with true values.

If you are a Griffiths & Armour client who has any queries on your current policy or the contents of this article, please get in touch with your usual contact or complete our contact form.